Contractor Insurance Near Me

Commercial general liability

An additional insured has less protection than the policyholder, but still gains crucial coverage, such as:Defense coverage. General liability coverage protects businesses against common business risks like customer injury, property damage, and advertising injury claims.

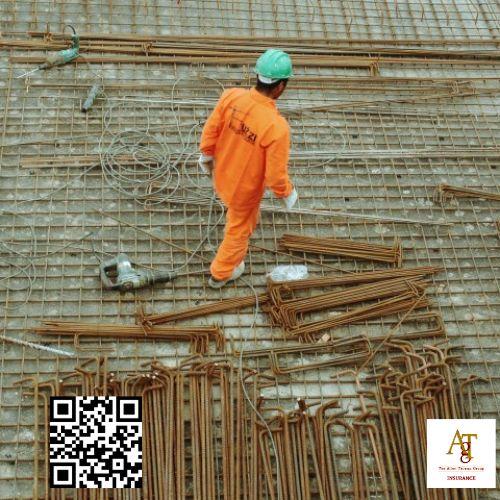

With so much fluctuation, damages easily occur to both the ongoing work and surrounding properties. Workers' compensation

General contractors have unique risks.

These policies often combine coverages such as commercial auto, workers compensation and business owners policies into one package.

Contractor Insurance Near Me - Installation floater

- Claims-made and reported policy

- Fidelity bond

- Directors and officers liability

- Surety bond

- Contractual liability insurance

- Retroactive date

The Allen Thomas Group Contractor Insurance .